This substack is about living the good life and indeed what exactly that means. This particular essay asserts that growth is requisite to living well. I don’t feel there is a need to defend this because it’s impossible to imagine life absent of growth from both physical and intellectual standpoints. Therefore, differences of opinion on this are a matter of degrees only.

What do I mean by growth? At its core, growth is a reduction in the effort needed to achieve some goal. This reduction is achieved through broadening one’s horizon. Because I’m interested in how choices can improve one’s life, I am specifically focusing on intellectual growth, rather than physical. This is because physical growth is involuntary.

In optimizing for growth, there is a tension I want to explore: in order to grow, one must take risks; on the other hand, growth requires some level of predictability i.e. removal of risk.

Can one grow without risk? The common-sense answer is yes. Of course, you are growing right now by reading this article, and what risk have you taken to do so?

I think, more subtly, the strict answer is no. Every choice comes with the risk that the choice is suboptimal. So, for example, reading this article might be a way to avoid doing something more important. This choice may be suboptimal, and that risk is run every single time you make a choice. A choice is actually the elimination of every other possible action one could have taken at that moment

😱

But this naive question (can one grow without risk?) doesn’t really offer much insight. A more interesting way to frame the question is: what is the relationship between risk and growth?

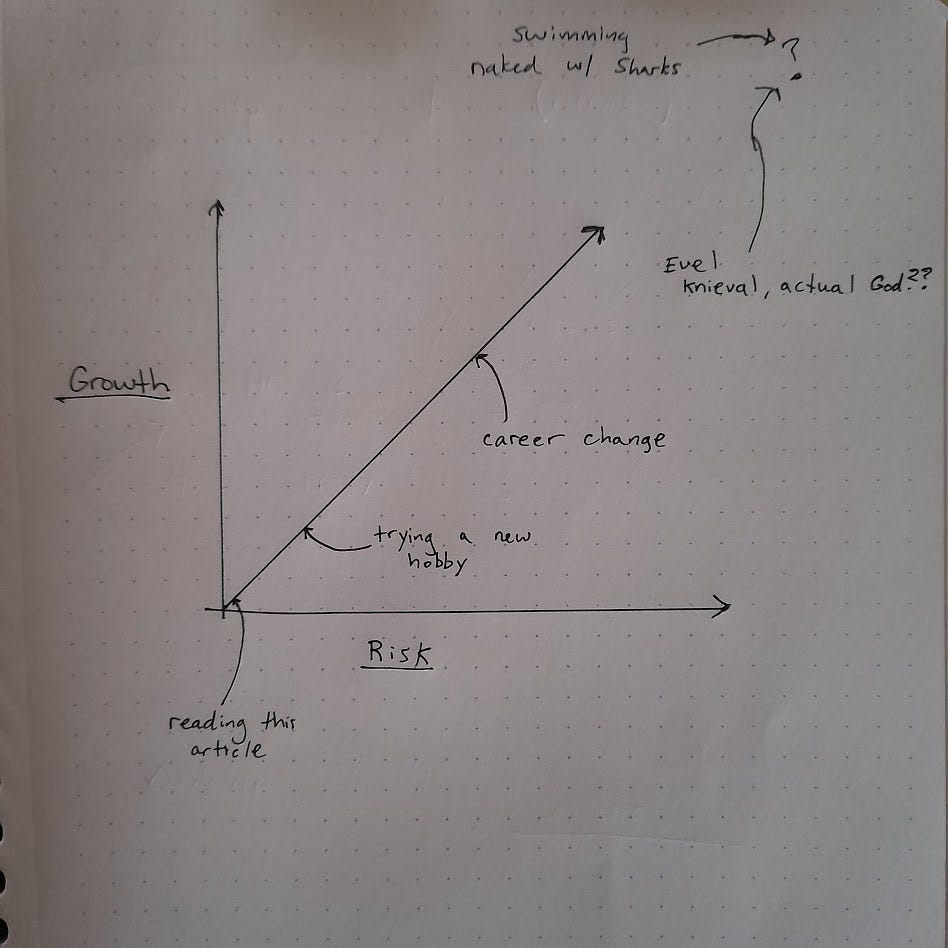

The common-sense answer is that the biggest opportunities for growth entail more risk than the smaller growth opportunities. A few examples to clarify this intuition:

- low risk/low growth potential: reading this article

- higher risk/higher growth potential: writing an article

- higher risk still/high growth potential: starting a personal blog

- and higher: starting a company

But clearly, this idea of linear increase is not exactly right. Otherwise, Evel Knieval would have been a freakish overlord hovering above the rest of us mere mortals:

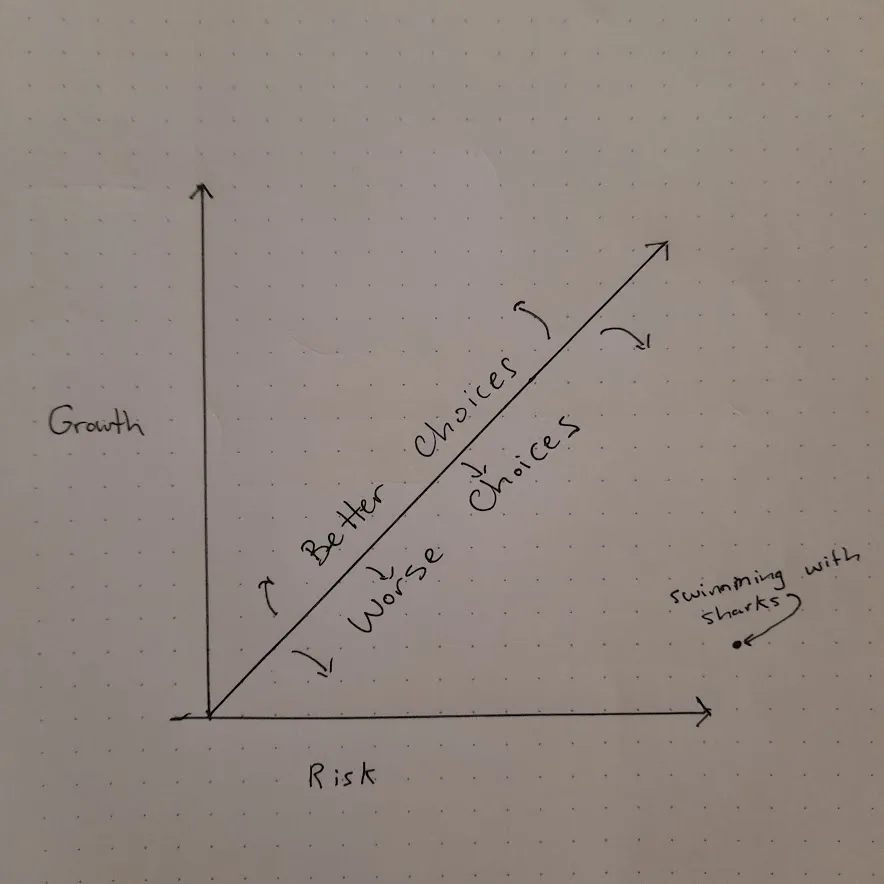

A clarification will correct this conclusion about Evel. The positive correlation between growth and risk is not for every possible action. It’s an indication of the upper limit of growth that can be expected at a given level of risk. With this improvement in understanding the graph looks more like this

We are in some very subjective water. Now is a good time to define our terms and acknowledge some (unavoidable?) subjectivity in this domain.

Risk: The likelihood of failure times the potential penalty for failure. In some cases, the penalty is simply opportunity cost (you wasted time reading an article and learned nothing), in other cases, it can be more severe (you tried a career change and it didn’t work out).

Growth: Reduction in the effort needed to achieve some goal (e.g. studying javascript to reduce the effort necessary to write useful software thus increasing the ability to be hired as a software developer).

Acknowledgment of (some of) the Subjectivity: We cannot measure these things. Growth itself get’s into some philosophic territory we don’t even want to start shadow boxing with. But it’s ok. We are just looking to pin down the general relationship to improve our intuition for making decisions about risk.

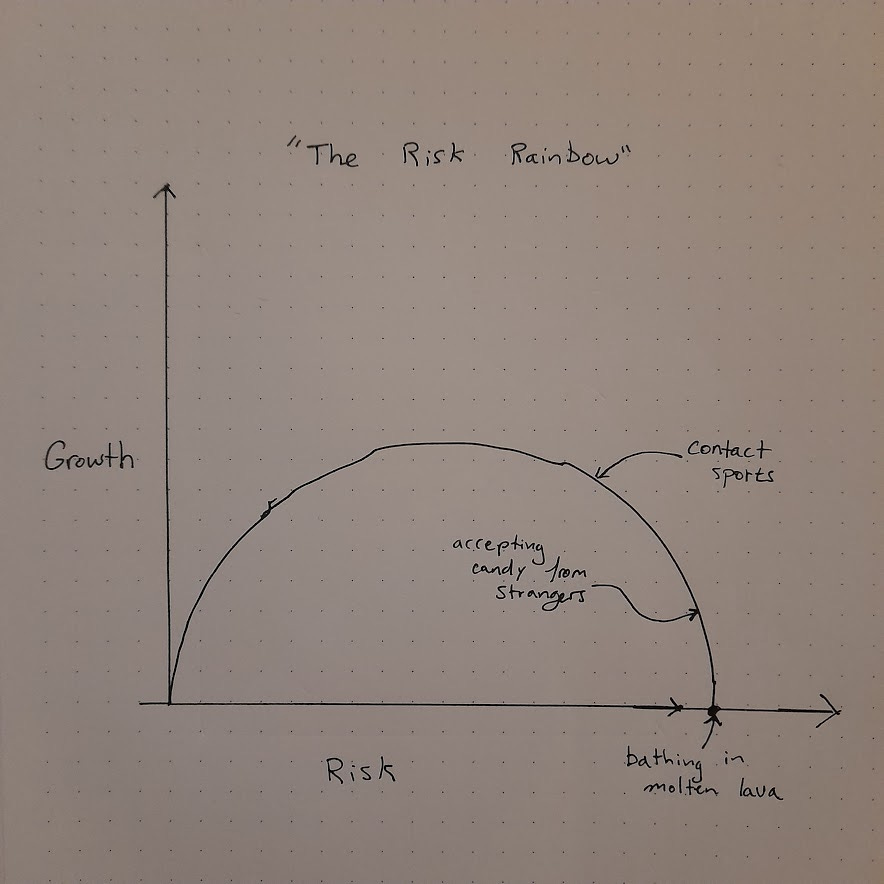

Another improvement to this framework would be to consider how the relationship evolves at higher levels of risk. A useful tool when thinking about conceptual relationships is to consider an extreme case. For example, what’s the riskiest choice we could possibly imagine, and what would be the expected growth potential? Obviously, the riskiest choice would be jumping directly into an active volcano. The growth potential is virtually zero. The Law of Continuity suggests that we should expect this terminus to be included in the relationship.

Making these changes, we end up with something like this:

Qualitatively this graph can offer a few simple reminders. Without some level of risk, we cannot grow. On the far left of the graph, there is a higher rate of return on increasing risk. Growth goes up steeply as you shift from no risk to a small amount. Some practical ways to reduce risk are:

-

Invest in transferable skills to reduce the opportunity cost of the investment. For example, public speaking is useful in a variety of domains.

-

Find a purpose for you life, if you work within the scope of this personal purpose there is less risk as you are more likely to continue on the course towards this purpose

-

Keep the expected results within your control, you cannot control how many views an article gets, you can control certain aspects of the quality and regularity of the content

-

Reduce the ambiguity of outcomes by making choices carefully and studying the various aspects of the likely outcomes.

-

Have a purpose in life — a clear purpose can increase continuity over time so various skills and investments compound, clarify expected outcomes, and increase motivation to overcome the fear and resistance to risk and discomfort.

In the end, a story is well suited when thinking about ambiguous challenges in life. A child learning to walk clarifies the ideal of growth. As the child learns to walk it will try more objectively risky things like running, jumping, dancing — however, the real risk stays about the same as the skills increase to compensate. Try to be like the child, every day pushing the limit and practicing just beyond the edge of your comfort level.

Originally published on Substack